Cream of Turkey & Wild Rice Soup

If you follow me on social media, you probably saw all the divine looking dishes that I had the pleasure of sampling at Brio Tuscan Grille last week at the new Liberty Center in West Chester. It’s always exciting to have a new restaurant around, especially one that I don’t have to drive all the way downtown for. (I am spoiled, I prefer to stay within a 15 mile radius of my home – especially with kids!)

I wasn’t sure what to expect, but we were served with the royal treatment. Our party got a whole table full of appetizers to try, which is like a girl’s dream. I always hate when I decide to try new things and I don’t end up liking it – I was able to try nearly every appetizer from their bar plates menu, and I have to admit I was pretty impressed. Not only was everything delicious, but they offer these bar menu items during happy hour for $3.95 to $5.95 during weekdays. I have already made plans with my family to come back and do some Christmas shopping, and then go to happy hour and split all the yummy appetizers.

I think my favorites were Crispy Tusca Tots which are fried bacon, mozzarella, and creamy potatoes served with a sriracha mayo – amazeballs I tell ya’! My second favorite would be the black pepper shrimp, which per the Chef is a restaurant fave. It comes with romano crusted eggplant, spicy black pepper cream sauce. I had never tried eggplant before, and I was pleasantly surprised how much I liked it! You can check out their entire Bar Plate Menu to see what else they have to offer!

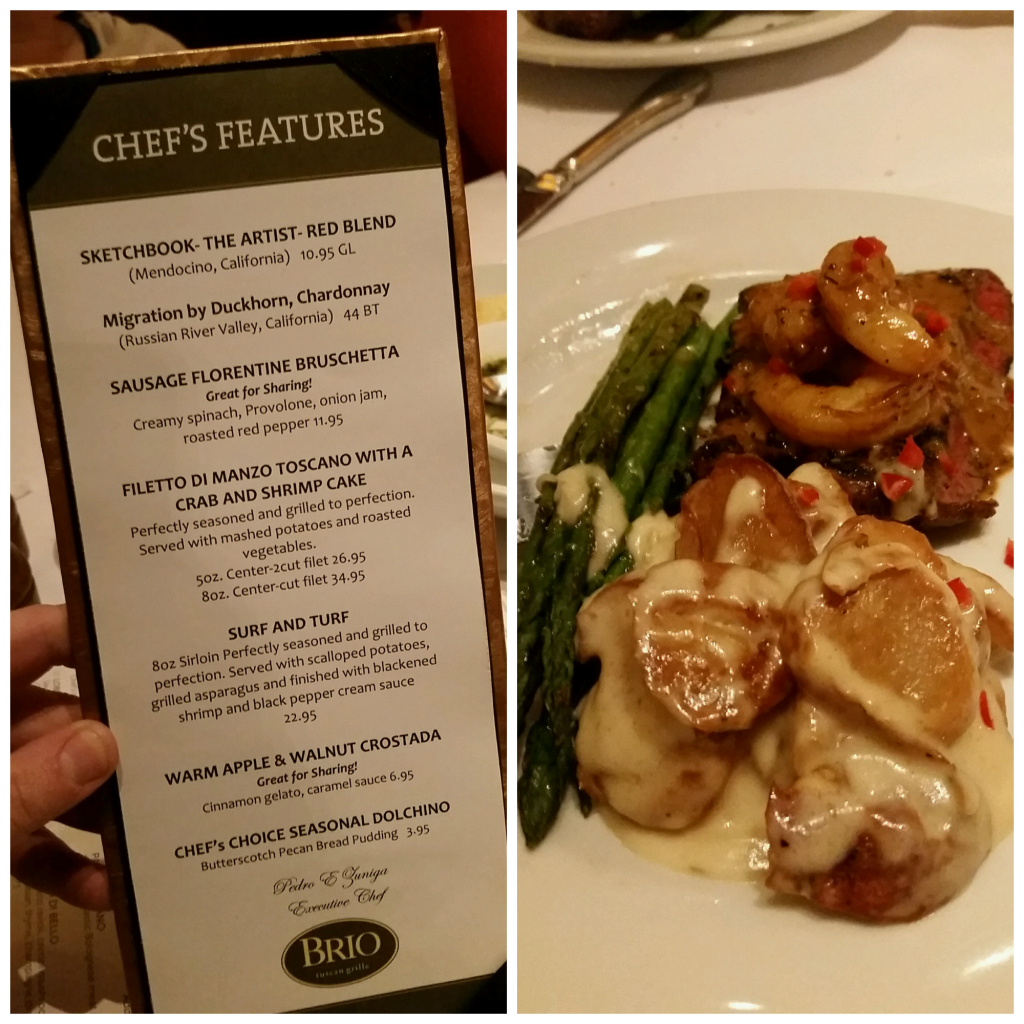

Next was entree time – and let me tell you, there was tons to choose from. My daughter came with me as my guest and food connoisseur so we decided to try something off the Chef’s Features Menu. The Chef really impressed us coming out to visit our table, describe all the dishes and take the time to make sure everything was perfect – so I figured we couldn’t go wrong.

We ordered the surf and turf which is of course steak and shrimp. It comes with a 8 oz sirloin, and the black pepper shrimp along with a side of grilled asparagus and scalloped potatoes. Now the picture below doesn’t do it justice, because my daughter and I split this meal, so this is literally half of what you would get, amazing hu?

The steak and shrimp were TO DIE FOR – the asparagus perfectly cooked. In fact, my daughter kept stealing some off my plate! The scalloped potatoes were O.K., a bit too saucy for me – I’m more of a baked potato girl myself. I realized after the fact I could of substituted or asked for less sauce since every plate is made to order. I would most definitely order again, and just substitute the potatoes – probably for more asparagus!

Just when we thought we couldn’t eat anymore – out came the desserts. As if I already hadn’t wished I wore stretchy pants instead of jeans! Again, our table was covered with some of the most delectable desserts I’ve ever seen. I was once again glad that I was able to sample an array of desserts so I knew what to order next time!

They have full size and petite desserts, which is awesome. Honestly just a few bites of each of these desserts was too much for me! But they were all delicious – everyone around me was surprised I had never tried creme brulee before and funny thing is, that was my absolute favorite! That and the cheesecake – which by the way is all made fresh, in house – were my 2 favorites.

Featured below is the cheesecake, tiramisu, chocolate layer cake, and the creme brulee. You can check out the full Brio Dessert Menu here.

So if you are out and about and want to try some great food at a awesome venue, you have to check out Brio. Be sure that if you are going during busy season (which will probably start this weekend) you can call or go online to make reservations!

Ingredients:

-2 Cups Rice Krispies

-1 Small Bag of Mini Marshmallows

-2 Tablespoons Butter (Melted)

-Food Coloring

Directions:

-Begin by Separating about 1/2 cup of rice krispies from your 2 cups and set aside

-Take 1 Tablespoon of your butter and melt in a microwave safe bowl

-Add in 1/4 of your bag of marshmallows and toss in the butter

-Microwave for one minute until melted

-Add in your 1/2 cup rice krispies until mixed together

-Spread this mixture out in your pie dish on the outer edges, this will act as your crust

-Now, Take your remaining butter and marshmallows and repeat the same steps you did to start your crust, this time add in orange food coloring before melting butter and marshmallows together

-Mix in the remaining 1 1/2 cups of rice krispies together and fill the rest of your pie dish

-Allow this to cool for about an hour until all hardened and cooled down

-Cut into triangular pieces and top with whipped cream

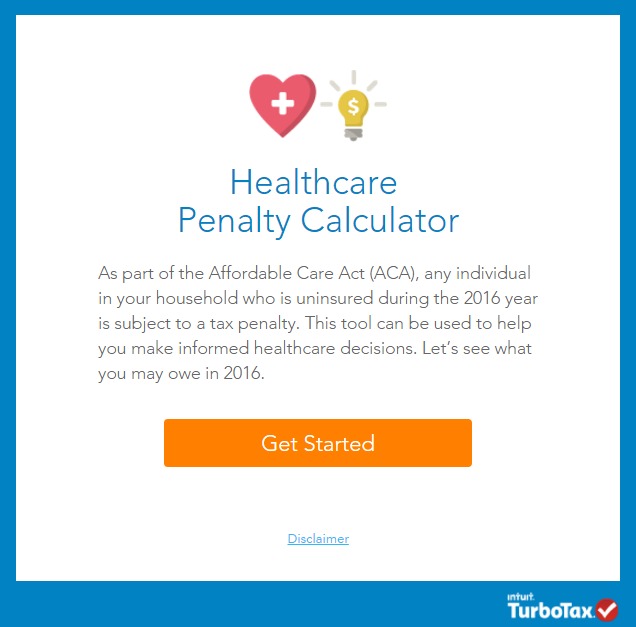

It’s almost that time of year again – income tax time. Some of us groan, others cheer all the way to the bank. But no matter if you get a refund or if you owe, we all have to answer the a new, sometimes anxiety -ridden question on the forms, “Do you have health insurance coverage?”

Last year I clicked the box with no hesitation – being on my husband’s employers health insurance plan was simple; it was affordable, we had a great HSA savings plan, and all seemed right with the world. I checked the box and moved on. However this year we find ourselves without any health insurance coverage – so where does it leave us??

For a majority of taxpayers, reporting their health insurance coverage this year, will be a lot like last year – like I did, you just check a box and that’s it. If you have insurance through an employer, government program, or private insurance company you may receive a 10-95 B or C form. You don’t need to send any copies in, or wait for them to file your taxes – since not everyone will get one – so they are for your records only. (So yes, definitely put in the KEEP not PITCH pile, file them away with your other important documents).

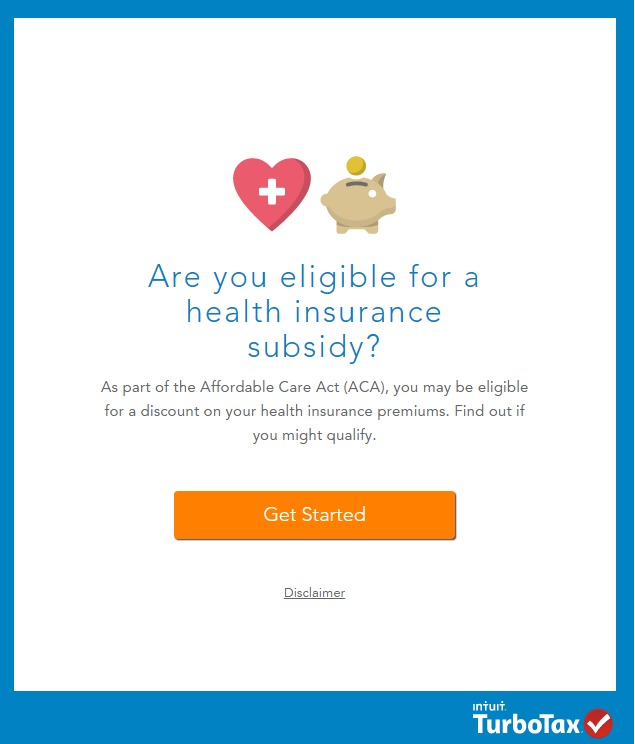

People who purchased a health insurance plan through healthcare.gov (or your state health care marketplace) you will receive a 1095-A Form, which will just confirm your coverage, premiums and subsidies you received to pay for your health insurance. When filing your taxes online through TurboTax, you enter the info much like you do your W-2. Enter all the details onto the site, and TurboTax takes care of the rest.

For the rest of us who will have to check the ‘no’ box under health insurance coverage this year, TurboTax does offer assistance to help you easily understand if you qualify for assistance to pay for health insurance, if you qualify for exemptions for going without insurance, and whether you will be responsible for a penalty – and how much- if you choose not to purchase health coverage.

TurboTax offers a plethora of free suite tools to help you understand how the ACA will affect their taxes, and the best thing of all? TurboTax doesn’t charge tax payers any extra feesfor health care-related forms!

So no matter if you are insured, uninsured, or in between TurboTax makes it easy to fill out all the necessary forms required – it’s so simple to answer the questions with a few clicks, you could even do it on your smartphone or tablet!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

This is a sponsored post on behalf of SOL ALPACA and the Mom It Forward Blogger Network. Though I’ve been compensated for my time, all opinions are my own.

The first time I ever saw an alpaca product I was at a festival where a small business owner was trying to get her business off the ground – I had never heard of using alpaca hair to knit/sew, so I was sorta’ kinda’ completely amazed at how soft and warm it was. Where had alpaca products been all my life??

When searching for a company that offers a wide array of selection using this fine fiber, I found SOL ALPACA had recently opened their online store to offer the world their products.

SOL ALPACA keeps Peru’s very ancient textile traditions alive while giving you the chance to wear the finest fibers of the Andes. The Andean people know warm, and using only alpaca and vicuña’s 32 natural shades create gorgeous modern-day designs that will knock your socks off!

Let SOL ALPACA keep you warm.

SOL APLACA products makes the perfect Christmas gift -especially for the person who seems to have it all. From their warm scarves to their ponchos, pullovers and vests, you can find the perfect gift for anyone on your list!

SOL ALPACA is giving one lucky All in a Days Work reader the chance to win a 30% off coupon to their online store! (This discount is 30% off the total amount of the purchase – only applicable to items that are regular price)

Enter by visiting the Sol Alpaca’s site find your favorite product, and come back here and leave the link in the comments!